By Jennifer Lynn Walker

In 2017 and 2019, Montreal experienced tremendous flooding. With many homes destroyed, it’s changed the way a lot of us are looking at real estate. The question arises for a lot of buyers looking close to water’s edge, how close it too close?

How can you protect yourself and buy comfortably?

Enjoy the incredible waterfront view but don’t let it blind you. Due diligence is less fun than dreaming but it prevents you from wasting time and money on offers that fall apart far before it saves you from future flood danger.

There is some research you can do online before you even decide to visit a property.

Read through the listing and ask your real estate broker to send you the declaration. The declaration is a six-page form that sellers must fill in with their knowledge of the house and the property’s history.

In it, the seller is obligated to disclose any type of water infiltration, flooding or if the house situated in a flood zone.

However, in some situations like a bank repossession or the sale of an estate, the seller may not know this information or have access to it. A property that has been owned for a long time will probably not have an updated certificate of location. As well, the sad fact is some sellers are clueless. You need to dig deeper.

Ask your real estate broker for the certificate of location to verify if the property is or isn’t in a flood zone. Make sure the certificate is up to date. There are many homes that never saw a flood before 2017, but the climate is changing, so you’ll want it to reflect at least that year.

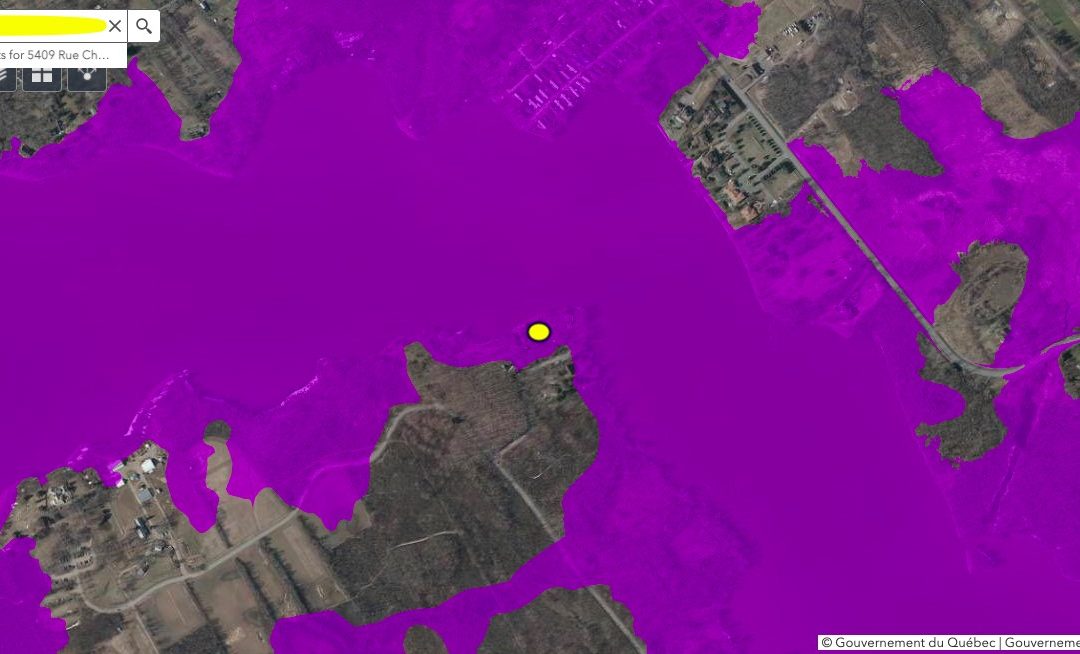

For extra information, you can check out the government website to see their estimate on the flood lines around a property. It’s as easy as putting in the address.

https://geoinondations.gouv.qc.ca/

Planning on Buying?

Did you know working with a Real Estate Broker is free?

Protect yourself, save time and avoid the pitfalls.

How has flooding changed the rules for bank mortgages and insurance?

Some banks won’t loan you money if the property you are looking at is in a flood zone. It will be up to them to decide how much flooding is too much flooding. And their criteria are getting tighter.

If the property has never flooded, yet it is in a flood zone, you may hit a roadblock at the bank. If the flood line touches the property’s edge, or even if the basement floods, the bank may refuse the deal.

Not all banks will act the same way. If you are determined to buy a property that floods, you may need an independent mortgage broker to help you find a bank that will lend you the money.

Another thing to consider is insurance coverage. When you are looking at a property, call around for a few quotes. If you don’t have time to do this, it’s also acceptable to add the ability to get a reasonable insurance rate from a trusted company as a condition in your offer.

The last thing to consider is the time and emotional trauma involved in dealing with a flood. A talk with someone who has been through the experience will help you get a realistic picture of the challenges involved and potential solutions.

The allure of waterfront property can be powerful. And everyone mitigates risk differently. You may decide to move forward, not finish the basement, and take your chances. Just be sure to arm yourself with good information before you enter a deal.

Below is Cap St Jacques, Pierrefonds. The yellow circle is a house. The purple is the flood zone according to ZIS.

Jennifer Lynn Walker has specialized in buying and selling residential and multiplex properties since 2003. She’s built a strong team of industry experts to give her clients seamless service. She’s also the founder of Montreal Real Estate Investor’s Group with 1,400+ members and Jolly Green Homes, a resource-series devoted to helping homeowners build an eco-friendly life. To learn more about Jenn click here.

This article was featured in: